Silver: The Versatile Warrior of the Industrial Age

Shining with a distinctive white luster and boasting impressive malleability and conductivity, silver holds a unique position in the industrial world. From adorning jewelry to safeguarding electronics and fueling renewable energy technologies, silver’s diverse applications are as essential as they are multifaceted. Let’s embark on a journey through the intricacies of the silver market, exploring its sources, applications, and key considerations for international traders and buyers.

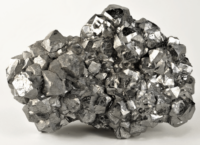

Description:

Silver primarily exists in silver sulfide ores like argentite and tetrahedrite. Extracting the metal involves a multi-step process, including mining, crushing, milling, flotation, and either cyanide leaching or fire assaying techniques. Silver content in ore varies significantly, impacting processing costs and overall yield.

Key Source Countries:

- Mexico: Leading producer, boasting vast silver reserves and established mining operations. Over 23% of global silver production originates from Mexico.

- China: Second-largest producer, contributing around 18% of global output. Key production regions include Yunnan and Guangxi.

- Peru: Holds approximately 15% of the global market share, with major production areas like Cerro Rico and Antamina.

- Australia: Significant producer, accounting for over 13% of global output. Queensland and New South Wales hold extensive silver deposits.

- Other notable producers: Bolivia, Poland, Chile, Argentina, and the United States contribute to the remaining global production.

World Output Volumes:

Global silver production reached aproximately 31,000 tonnes in 2023, showcasing modest growth over the past decade. Mexico and China continue to expand their operations, while other major producers explore new projects. Fluctuations in demand and supply dynamics, particularly from Mexico, can cause price volatility.

Major Producers and Market Share:

- Fresnillo plc: The world’s largest primary silver producer, controlling roughly 5% of the global market. Operates extensive mines in Mexico and Peru.

- Sociedad Quimica y Minera de Chile (SQM): Chilean mining giant, accounting for around 4% of global silver output.

Focuses on responsible mining practices and diversified - production portfolio.

- BHP Billiton: Australian company with significant silver production in Australia and Chile, holding aproximately 3% of the global market share.

- Glencore: Swiss multinational commodities trading and mining company, contributing around 3% of global silver production.

- Other major producers: First Majestic Silver Corp, KGHM

Polska Miedz SA, Coeur Mining Inc, Pan American Silver - Corp, and numerous smaller players contribute to the remaining market share.

Forms of Trade:

Silver is primarily traded in two forms:

- Silver ingots: Large, refined blocks of pure silver (over 99.9% silver content). Used as raw material for downstream processing into various products.

- Silver coins: Minted silver pieces of varying denominations and purity (commonly .999 fine). Used for jewelry, investment, and collector purposes.

Price Trends (Past 5 Years):

- 2019: Prices hovered around $17 per ounce due to balanced

supply and demand. - 2020: Pandemic disruptions caused a decrease to around $12

per ounce before recovering moderately. - 2021: Surging demand for solar panels and electronics, coupled with supply chain disruptions, pushed prices to over $28 per ounce.

- 2022: Prices corrected downwards to around $24 per ounce due to concerns about slowing global growth and rising energy costs.

- 2023: Prices maintained some volatility between $22 and $27

per ounce, influenced by geopolitical tensions and the pace of economic recovery.

Major Importing Countries:

- India: Leading importer, driven by strong cultural demand for silver jewelry and investment purposes.

- China: Major importer, despite being a significant producer, to meet its growing domestic demand for electronics and industrial applications.

- United States: Significant importer for jewelry manufacturing, electronics, and investment purposes.

- United Arab Emirates: Growing import hub, fueled by increasing demand for silver jewelry and investment in the region.

European Union: Collectively a significant importer, relying on diverse sources for its silver consumption.

Major Exporting Countries:

- Mexico: Dominant exporter, accounting for approximately 30% of global silver exports.

- Peru: Significant exporter, contributing around 20% of global silver trade.

- Australia: Major exporter, with a long history of silver mining and established export channels.

- Bolivia: Significant exporter, contributing around 15% of global silver exports.

- Other notable exporters: Chile, Poland, and Argentina contribute to the remaining global exports.

Important Aspects for International Traders and Buyers

Navigating the silver market requires careful consideration of various factors due to its diverse applications and sensitivity to economic fluctuations. Here are some key points for international traders and buyers:

Demand Fluctuations:

- Jewelry: Monitor trends in global jewelry consumption, particularly in key markets like India and China, which can significantly impact silver demand.

- Electronics: Stay informed about advancements in miniaturization and alternative materials that could affect silver demand in electronics manufacturing.

- Renewable energy: Explore the potential impact of solar panel technology advancements and alternative conductive materials on future silver demand.

Supply Chain Risks:

- Geopolitical tensions: Disruptions in major producing countries like Mexico, China, or Peru can significantly impact supply and prices.

- Environmental regulations: Stringent regulations on mining and processing can affect production costs and potential supply disruptions.

- Ethical sourcing: Ensure your suppliers adhere to responsible mining practices and environmental regulations.

Quality Variations:

• Silver content: Understand the exact percentage of silver (typically ranging from 99.9% to 99.99% to ensure it meets downstream processing or investment requirements.

- Impurities: Analyze the presence of impurities like copper, lead, or zinc, as they can influence the metal’s conductivity, malleability, and suitability for specific applications.

- Form and specification: Choose between silver ingots, coins, flakes, or specific alloys depending on your end-use needs and international regulations.

Price Volatility:

- Hedging strategies: Employ hedging instruments like options and futures contracts to mitigate price fluctuations, especially for large transactions.

- Market analysis: Track key economic indicators and industry trends to anticipate potential price movements.

- Cost flexibility: Factor in potential price volatility when calculating project costs and margins.

Logistics and Transportation:

- Shipping routes: Evaluate different shipping routes based on cost, timeliness, and security, considering silver’s classification as a hazardous material in some forms.

- Insurance: Secure adequate insurance coverage for your silver shipments to mitigate potential risks of loss or damage.

- Import duties and regulations: Be aware of import duties and customs regulations in the destination country, including potential hallmarks or purity certification requirements.

Financing Options:

- Trade finance: Explore trade finance instruments like letters of credit to secure transactions and manage payment risks, especially for international trade.

- Commodity financing: Consider specialized financing solutions designed for commodity trade, potentially offering competitive rates and flexible terms.

Payment terms: Negotiate favorable payment terms with suppliers, balancing risk mitigation with cash flow needs.

Investment Considerations:

• Investment horizon: Tailor your investment strategy to your long-term financial goals, as silver can exhibit both short-term volatility and long-term value appreciation.

- Portfolio diversification: Allocate a portion of your portfolio to silver to potentially benefit from its diversification benefits and potential hedge against inflation.

- Storage and security: Choose secure storage solutions for your physical silver holdings, considering options like bank vaults, bonded warehouses, or insured private facilities.

Emerging Technologies:

- 3D printing: Stay informed about the potential use of recycled silver in 3D printing applications, which could create new demand opportunities.

- Nanotechnology: Monitor advancements in nanotechnology using silver nanoparticles, which could lead to new industrial applications and potential demand growth.

- Antimicrobial technologies: Explore the increasing use of silver in antimicrobial coatings and applications, particularly in healthcare and consumer products.