Platinum: The Enduring Shine of Industrial Elegance

Platinum, a lustrous white metal prized for its strength, resistance to corrosion, and catalytic properties, plays a key role in diverse industries ranging from automotive exhaust systems to jewelry and electronics. Here’s a comprehensive exploration of the platinum market, delving into its sources, applications, and key considerations for international traders and buyers.

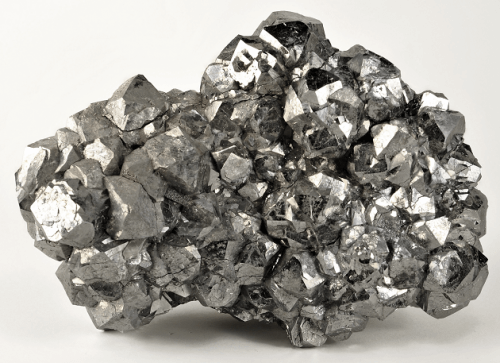

Description:

Platinum primarily exists in platinum group metals (PGM) ores like platinum-bearing sulfide minerals. Extraction involves a multi-step process, including mining, crushing, milling, flotation, and either pyrometallurgical or hydrometallurgical methods. Platinum content in ore varies significantly, impacting processing costs and overall yield.

Key Source Countries:

- South Africa: Leading producer, boasting vast PGM reserves and established mining operations. Over 70% of global platinum production originates from South Africa.

- Russia: Second-largest producer, contributing around 12% of global output. Key production regions include Norilsk and the Urals.

- Zimbabwe: Holds approximately 7% of the global market share, with significant platinum and palladium deposits.

- Canada: Significant producer, accounting for around 6% of global output. Sudbury and Voisey’s Bay hold extensive PGM deposits.

- Other notable producers: Ethiopia, Colombia, and the United States contribute to the remaining global production.

World Output Volumes:

Global platinum production reached approximately 8.14 million ounces in 2024, showcasing stable growth over the past decade.

South Africa continues to dominate output, while other major producers explore new projects and resource expansion.

Fluctuations in demand and supply dynamics, particularly from South Africa, can cause price volatility.

Major Producers and Market Share:

- Norilsk Nickel: Russian mining giant, controlling roughly 25% of the global platinum market. Renowned for its integrated production chain and vast PGM reserves.

- Anglo American Platinum: South African company with dominant market share in platinum production, holding approximately 18% of the global market.

- Implats: South African producer, contributing around 15% of global platinum output. Focuses on responsible mining practices and operational efficiency.

- Sibanye Stillwater: South African company with significant

PGM production in South Africa and the United States, accounting for around 12% of the global market share. - Other major producers: Lonmin Plc, Northam Platinum Holdings Ltd, MMC Norilsk Copper, and numerous smaller players contribute to the remaining market share.

Forms of Trade:

Platinum is primarily traded in two forms:

- Platinum bars: Large, refined blocks of pure platinum (over 99.5% platinum content). Used as raw material for downstream processing into various products.

- Platinum sponge: Porous platinum concentrate requiring further refining. Primarily used in the production of automotive catalysts.

Price Trends (Past 5 Years):

- 2019: Prices hovered around $8,600 per ounce due to balanced supply and demand.

- 2020: Pandemic disruptions caused a decrease to around $6,800 per ounce before recovering moderately.

- 2021: Surging demand for automotive catalysts due to stricter emission regulations pushed prices to over $1,300 per ounce.

- 2022: Prices corrected downwards to around $980 per ounce due to concerns about slowing global growth and the rise of electric vehicles.

- 2023: Prices maintained some volatility between $850 and $1,020 per ounce, influenced by geopolitical tensions and the pace of electric vehicle adoption.

Major Importing Countries:

- China: Leading importer, driven by demand for automotive catalysts and industrial applications.

- Japan: Major importer, reliant on South Africa and Russia for its platinum supply.

- United States: Significant importer for jewelry manufacturing, chemical catalysts, and automotive applications.

- Germany: Important European importer, using platinum in the automotive and chemical industries.

- South Korea: Major importer, particularly focused on the automotive sector.

Major Exporting Countries:

- South Africa: Dominant exporter, accounting for approximately 75% of global platinum exports.

- Russia: Significant exporter, contributing around 15% of global platinum trade.

- Zimbabwe: Growing exporter, with potential to increase its share in the coming years.

- Canada: Major exporter, primarily focusing on refined platinum products.

Other Important Aspects for Traders and Buyers:

- Competition from palladium: Be aware of the ongoing substitution of platinum with palladium in automotive catalysts, which can impact demand dynamics.

- Emerging technologies: Stay informed about potential advancements in hydrogen fuel cells and other platinum-intensive technologies that could influence future demand.

- Responsible sourcing: Choose suppliers adhering to

Navigating the platinum market requires careful consideration of various factors due to its diverse applications, price volatility, and complex supply chain. Here are some key points for international traders and buyers:

Demand Fluctuations:

- Automotive: Monitor trends in global vehicle production and emission regulations, particularly in key markets like China and Europe, which significantly impact demand for automotive catalysts.

- Jewelry: Track consumer preferences and cultural trends in major jewelry markets like China, India, and the Middle East, influencing platinum’s appeal as a jewelry material.

- Industrial applications: Stay informed about advancements in chemical processing, petroleum refining, and other industrial sectors using platinum catalysts, understanding potential shifts in demand.

Investment: Track global economic uncertainties, interest rates, and geopolitical tensions, as these factors heavily influence platinum’s appeal as a safe-haven asset.

Supply Chain Risks:

- Geopolitical tensions: Disruptions in major producing countries like South Africa, Russia, or Zimbabwe can significantly impact supply and prices.

- Labor unrest: Be aware of potential labor disputes and strikes in mines, which can disrupt production and cause supply chain bottlenecks.

Environmental regulations: Stringent regulations on mining and processing can affect production costs and potential supply disruptions. - Ethical sourcing: Ensure your suppliers adhere to responsible mining practices and environmental regulations.

Quality Variations

- Platinum content: Understand the exact percentage of platinum (typically ranging from 99.5% to 99.9% to ensure it meets downstream processing or investment requirements.

- Impurities: Analyze the presence of impurities like iridium, rhodium, or palladium, as they can influence the metal’s physical properties and suitability for specific applications.

- Form and specification: Choose between platinum bars, sponge, powder, or specific alloys depending on your end-use needs and international regulations.

Price Volatility:

- Hedging strategies: Employ hedging instruments like options and futures contracts to mitigate price fluctuations, especially for large transactions.

- Market analysis: Track key economic indicators and industry trends to anticipate potential price movements.

- Cost flexibility: Factor in potential price volatility when calculating project costs and margins.

Logistics and Transportation:

- Shipping routes: Evaluate different shipping routes based on cost, timeliness, and security, considering platinum’s classification as a high-value commodity.

- Insurance: Secure adequate insurance coverage for your platinum shipments to mitigate potential risks of loss or damage.

Import duties and regulations: Be aware of import duties and customs regulations in the destination country, including potential value-added taxes or specific licensing requirements.

Financing Options:

- Trade finance: Explore trade finance instruments like letters of credit to secure transactions and manage payment risks, especially for international trade.

- Commodity financing: Consider specialized financing solutions designed for commodity trade, potentially offering competitive rates and flexible terms.

- Payment terms: Negotiate favorable payment terms with suppliers, balancing risk mitigation with cash flow needs.

-

Investment Considerations:

- Investment horizon: Tailor your investment strategy to your long-term financial goals, as platinum can exhibit both short-term volatility and long-term value appreciation.

- Portfolio diversification: Allocate a portion of your portfolio to platinum to potentially benefit from its diversification benefits and potential hedge against inflation.

- Storage and security: Choose secure storage solutions for your physical platinum holdings, considering options like bank vaults, bonded warehouses, or insured private facilities.

Emerging Technologies:

- Hydrogen fuel cells: Stay informed about the development and commercialization of hydrogen fuel cells, which use platinum as a key component, understanding its potential impact on future demand.

- Additive manufacturing: Monitor the use of platinum in 3D printing applications, which could create new demand opportunities.

- Sustainable and responsible sourcing: Be aware of advancements in technologies and initiatives promoting sustainable and responsible platinum mining practices, considering consumer preferences and potential regulatory changes.