US Metals Demand in 2025: A Forecast

The United States, a global economic powerhouse, is a significant consumer of metals. As the nation continues its economic recovery and embarks on ambitious infrastructure and clean energy initiatives, the demand for various metals is poised to grow.

Key Metals Driving US Demand

Several key metals are expected to see increased demand in the US in 2025:

- Copper:

- Demand Drivers: The electrification of transportation, renewable energy infrastructure, and construction activities will significantly boost copper demand.

- Supply Concerns: Limited new copper mine developments and geopolitical tensions in key producing regions could constrain supply, potentially leading to price volatility.

- Aluminum:

- Demand Drivers: The aerospace, automotive, and construction industries are major consumers of aluminum. As these sectors continue to grow, so too will aluminum demand.

- Supply Challenges: Energy-intensive aluminum production and environmental regulations could impact supply, particularly from carbon-intensive sources.

- Steel:

- Demand Drivers: Infrastructure projects, construction activities, and manufacturing industries will drive steel demand.

- Supply Considerations: Domestic steel production capacity and trade policies will influence supply and pricing.

- Rare Earth Elements (REEs):

- Demand Drivers: REEs are critical for various high-tech applications, including electronics, renewable energy technologies, and defense systems.

- Supply Dominance: China’s dominance in REE mining and processing could pose challenges for US supply chain security.

- Lithium:

- Demand Drivers: The burgeoning electric vehicle market and energy storage solutions will drive lithium demand.

- Supply Constraints: Limited lithium mining capacity and geopolitical risks could impact supply and pricing.

Major Metal Imports and Trade Partners

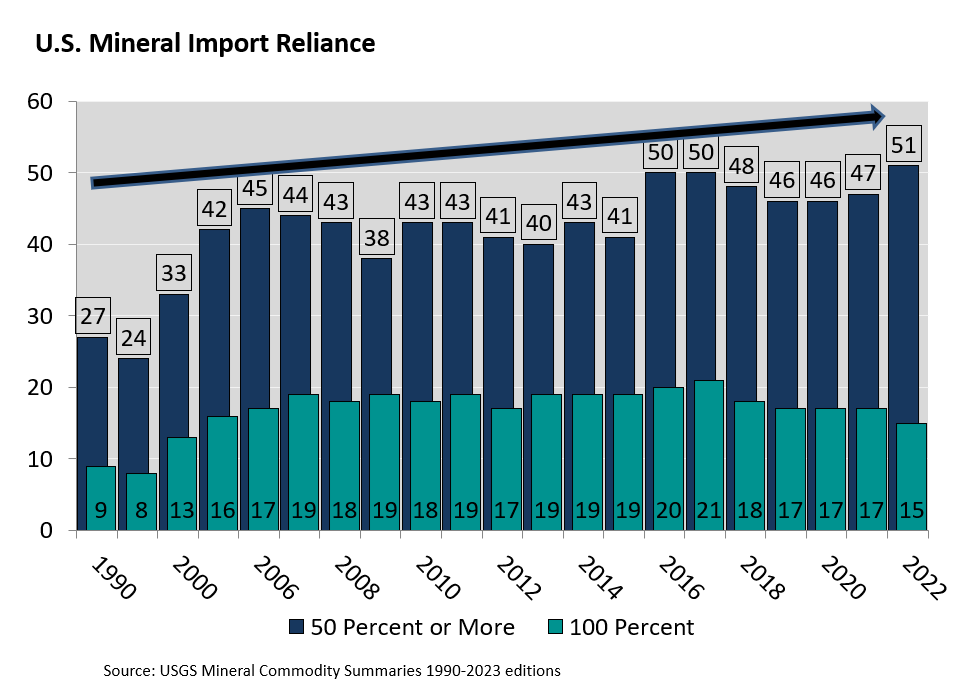

The US is a net importer of many metals, relying heavily on foreign sources to meet its demand. Key import sources include:

- Canada: A major supplier of aluminum, nickel, and other metals.

- China: A significant source of rare earth elements, steel, and other metals, although geopolitical tensions have impacted trade relations.

- Australia: A major exporter of lithium, iron ore, and other minerals.

- Chile: A leading producer of copper.

Trends and Predictions for 2025

Several trends are likely to shape the US metals market in 2025:

- Domestic Production: The US government is increasingly focused on domestic production of critical minerals to reduce reliance on foreign suppliers. This could lead to increased investment in domestic mining and processing facilities.

- Recycling and Circular Economy: Efforts to promote recycling and circular economy practices will become more important, especially for metals like copper and aluminum.

- Technological Advancements: Technological advancements in mining, processing, and battery technologies could impact metal demand and supply dynamics.

- Geopolitical Factors: Geopolitical tensions and trade disputes could disrupt supply chains and lead to price volatility.

- Climate Change and Sustainability: The transition to a low-carbon economy will drive demand for metals used in renewable energy technologies, while also raising concerns about the environmental impact of mining and processing.

In conclusion, the US metals market in 2025 is expected to be influenced by a complex interplay of factors, including domestic demand, global supply chains, technological advancements, and geopolitical risks. By understanding these trends, stakeholders can make informed decisions and navigate the evolving landscape of the metals industry.