India & Metals: 2025

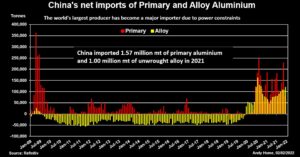

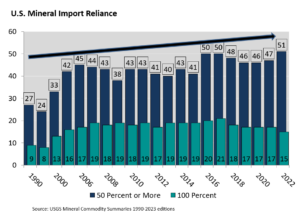

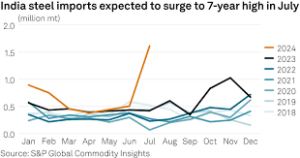

India’s metals market in 2025 is poised for significant growth, driven by strong domestic demand and ambitious infrastructure projects. However, the country’s reliance on imports, environmental concerns, and geopolitical risks could pose challenges to its metal supply chain. By understanding these trends, stakeholders can make informed decisions and navigate the complex landscape of India’s metals market.